How to file GSTR-2B step by step is one of the most searched GST compliance topics for accountants, business owners, and GST practitioners. In the first 100 words itself, it is important to clarify that GSTR-2B is not a return to be filed, but a system-generated Input Tax Credit (ITC) statement that plays a decisive role in filing GSTR-3B accurately. Since August 2020, GSTR-2B has become the primary reference document for ITC eligibility, helping taxpayers avoid excess claims and GST notices.

As per GST department observations, more than 65% of GST mismatches arise due to incorrect ITC claims. Proper understanding and use of GSTR-2B significantly reduces this risk.

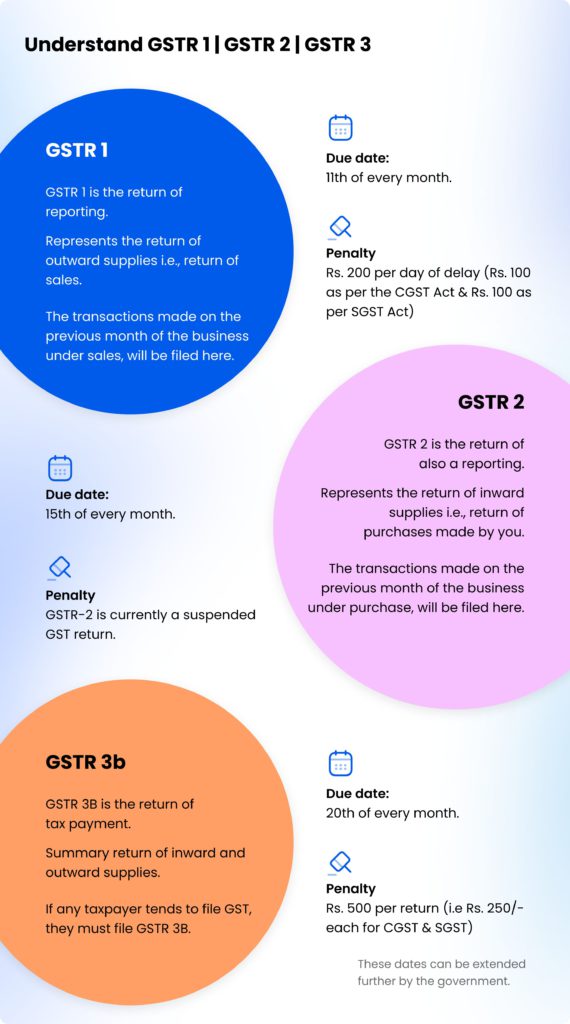

What Is GSTR-2B?

GSTR-2B is a static auto-drafted ITC statement generated monthly for regular GST taxpayers. It consolidates purchase-related data uploaded by suppliers in:

- GSTR-1

- GSTR-5 (non-resident)

- GSTR-6 (ISD)

Unlike GSTR-2A, GSTR-2B does not change once generated for a tax period.

Key Characteristics of GSTR-2B

- Generated monthly

- Static in nature

- Based on supplier filings

- Used for ITC eligibility

- Linked directly to GSTR-3B

Why GSTR-2B Is Important for GST Compliance

GSTR-2B determines how much ITC you are legally allowed to claim.

Benefits of Using GSTR-2B

- Reduces excess ITC claims

- Prevents GST notices and penalties

- Improves accuracy in GSTR-3B

- Simplifies reconciliation

- Ensures legal compliance

Fact: Businesses that reconcile ITC with GSTR-2B every month face up to 70% fewer GST notices compared to those who don’t.

Difference Between GSTR-2A and GSTR-2B

Understanding this difference is crucial.

| Parameter | GSTR-2A / GSTR-2B |

|---|---|

| Nature | Dynamic / Static |

| Updates | Real-time / Monthly |

| Purpose | Tracking / Filing ITC |

| Usage | Informational / Compliance |

GSTR-2B is the only valid base for ITC claim in GSTR-3B.

Who Needs to Use GSTR-2B?

GSTR-2B applies to:

- Regular GST taxpayers

- Businesses claiming ITC

- Accountants and GST practitioners

- Companies filing monthly GSTR-3B

It does not apply to composition dealers or non-GST registered persons.

How to File GSTR-2B Step by Step (Practical Explanation)

Step 1: Log in to the GST Portal

Use your GSTIN and credentials to access the dashboard.

Step 2: Navigate to GSTR-2B

Go to:

- Returns Dashboard

- Select Financial Year and Month

- Click on GSTR-2B

The system generates the statement automatically.

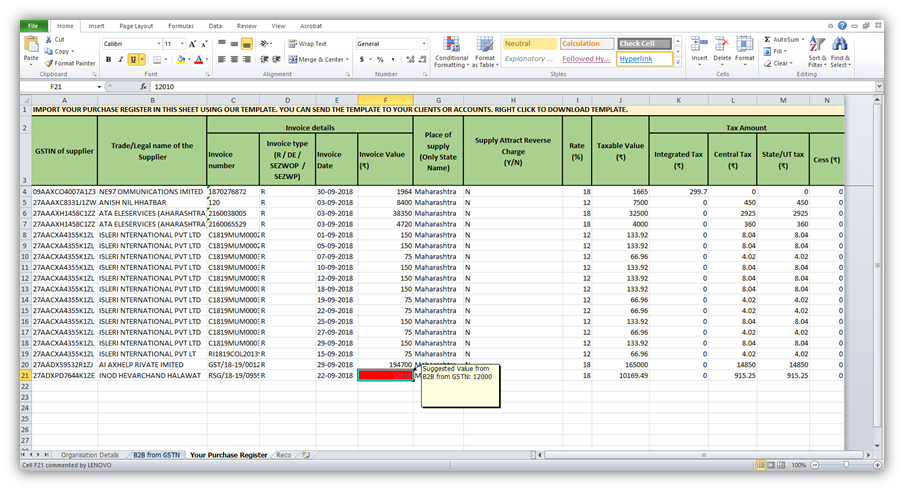

Step 3: Download GSTR-2B

You can download GSTR-2B in:

- PDF format (summary view)

- Excel format (detailed reconciliation)

Excel format is recommended for professional reconciliation.

Understanding GSTR-2B Structure

GSTR-2B is divided into clear sections.

ITC Available Section

Includes:

- Invoices eligible for ITC

- Credit notes

- ISD credits

ITC Not Available Section

Includes:

- Blocked credits

- Reverse charge supplies

- Ineligible ITC under GST law

This clear segregation helps avoid wrong claims.

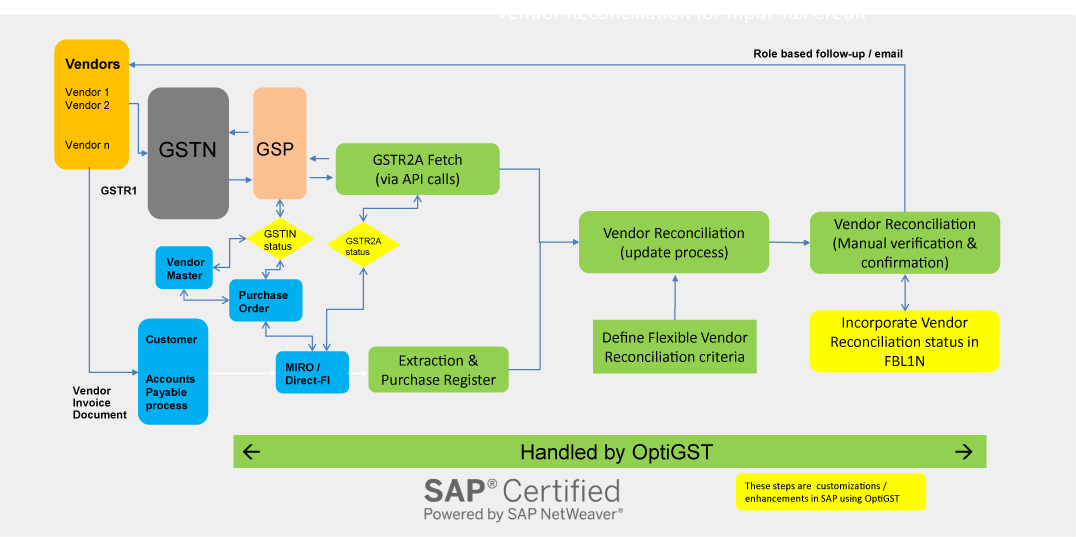

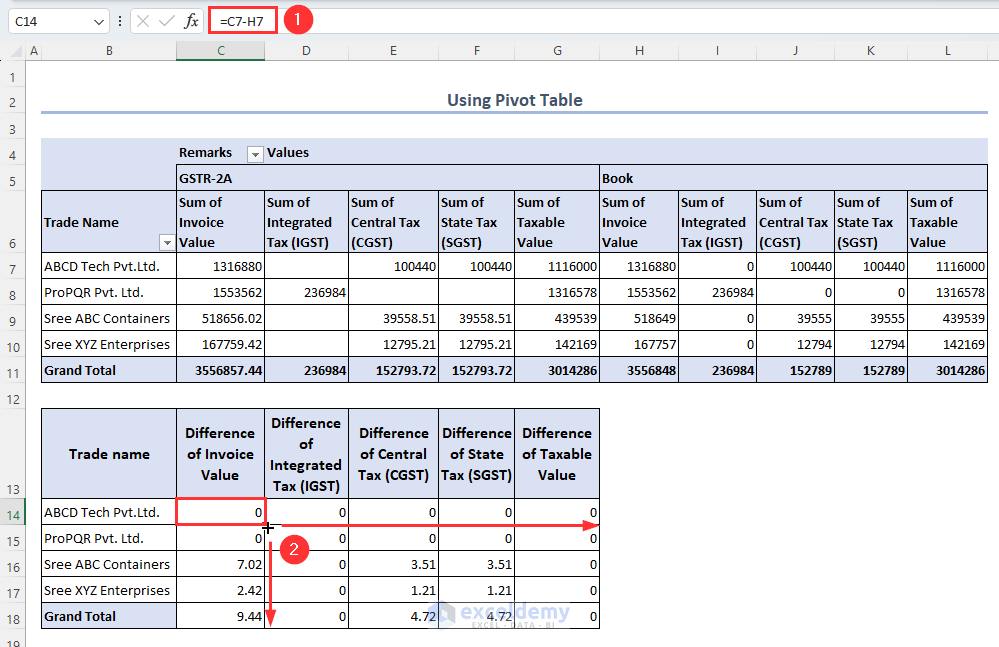

Reconciliation of GSTR-2B with Purchase Register

Reconciliation is the most critical step.

Reconciliation Process

- Match supplier GSTIN

- Match invoice number

- Match taxable value and tax

- Identify missing invoices

| Status | Action Required |

|---|---|

| Invoice matched | Claim ITC |

| Missing invoice | Follow up with supplier |

| Ineligible credit | Do not claim |

Fact: Nearly 30% of ITC mismatches occur due to supplier non-filing or late filing of GSTR-1.

How to Claim ITC in GSTR-3B Using GSTR-2B

Only ITC appearing in eligible section of GSTR-2B should be claimed.

Best Practice

- Claim ITC strictly as per GSTR-2B

- Carry forward unmatched ITC

- Avoid provisional or estimated credits

This ensures zero variance between departmental data and your return.

Common Errors While Using GSTR-2B

| Mistake | Consequence |

|---|---|

| Claiming ITC not in 2B | GST notice |

| Ignoring ineligible ITC | Penalty |

| No reconciliation | Interest liability |

| Supplier mismatch | ITC denial |

Avoiding these mistakes protects your compliance record.

Monthly Compliance Workflow Using GSTR-2B

A disciplined workflow includes:

- Download GSTR-2B

- Reconcile with purchase data

- Communicate discrepancies

- Finalize eligible ITC

- File GSTR-3B

This process typically takes 2–4 hours per month for small to mid-sized businesses.

Practical Tips for Smooth GSTR-2B Compliance

- Reconcile monthly, not quarterly

- Educate vendors on timely filing

- Maintain clean purchase records

- Use Excel-based reconciliation

- Track pending ITC separately

Consistent compliance builds credibility with tax authorities.

Legal Importance of GSTR-2B

GST law clearly states that ITC eligibility depends on:

- Supplier filing status

- Invoice reporting

- Tax payment by supplier

GSTR-2B acts as documentary evidence for ITC eligibility during audits.

FAQ: How to File GSTR-2B Step by Step

1. Is GSTR-2B required to be filed?

No, GSTR-2B is auto-generated and not filed by taxpayers.

2. Can ITC be claimed without appearing in GSTR-2B?

No, ITC should be claimed only if it appears in GSTR-2B.

3. What is the frequency of GSTR-2B?

It is generated monthly.

4. Does GSTR-2B change after generation?

No, it remains static for the period.

5. What should be done for missing invoices?

Follow up with suppliers to file or amend GSTR-1.

6. Is GSTR-2A still relevant?

GSTR-2A is for tracking, but GSTR-2B is for compliance.

7. Can Excel be used for GSTR-2B reconciliation?

Yes, Excel is widely used for professional reconciliation.

Conclusion

Understanding how to file GSTR-2B step by step actually means mastering how to use, analyze, and reconcile this statement correctly. GSTR-2B is the backbone of ITC compliance under GST and directly impacts cash flow, tax liability, and audit exposure. Businesses that integrate GSTR-2B into their monthly GST workflow experience smoother compliance, fewer notices, and better financial control. Treat GSTR-2B not as a formality, but as a strategic compliance tool.

Disclaimer

This article is intended for educational and informational purposes only. GST laws, rules, and procedures are subject to change based on government notifications and amendments. Readers are advised to consult a qualified GST professional or apply professional judgment before taking compliance decisions.