🇮🇳 India’s Strength in Words: Why the RBI Governor’s Statement Matters More Than Political Rhetoric

In a world often dominated by populist political statements and global trade tension, the recent remarks by India’s Reserve Bank of India (RBI) Governor—a non-political, professional economist—carry special weight. His calm yet firm rebuttal to claims labelling India as a “dead economy” is not just a response to noise, but a clarion call reinforcing India’s economic resilience.

🎙️ Why the RBI Governor’s Voice Matters More

Unlike elected leaders or political influencers, the RBI Governor is apolitical and independent, guided only by data, macroeconomic realities, and national interest. When Governor Sanjay Malhotra says India is growing at 6.5% and contributing 18% to global GDP growth, it isn’t spin. It’s fact.

His position demands rigorous analysis, neutrality, and foresight. This makes his statement far more credible than politically charged comments. While a politician may gain by downplaying or exaggerating economic situations, the RBI cannot afford either.

📊 Debunking the “Dead Economy” Myth

The RBI Governor’s statement came in response to former US President Donald Trump’s remark calling India a “dead economy.” However, the reality, as explained by the central bank, is quite the opposite:

- India is one of the top contributors to global economic growth—even ahead of the United States in terms of contribution percentage.

- It has a robust domestic demand, a vibrant services sector, and rapid digitalisation, all fueling inclusive growth.

- Macro indicators are healthy: inflation is under control, forex reserves are stable, and the banking sector is stronger than ever.

🚢 Understanding the 50% US Tariff – What It Means for India

There’s been anxiety over Trump’s suggested 50% tariff on Chinese and possibly Indian imports if he returns to office. But let’s break this down:

- India isn’t China: Our exports are largely specialised, including pharmaceuticals, IT services, gems & jewellery, textiles, automotive components, and skilled human capital. These aren’t easily replaceable.

- Minimal Direct Impact: While a few sectors may feel the pinch, India’s overall export to the US is diversified and unlikely to suffer massive contraction. The US needs Indian software, drugs, and diamonds—things it can’t easily get from domestic sources or other markets.

- Alternative Markets: India’s aggressive push in Middle East, Africa, Europe, and Southeast Asia means we’re not heavily reliant on the US anymore. Trade deals with the UAE, Australia, and talks with the EU & UK show India is already shifting gears.

🌍 Turning Tariff Threats into a Strategic Advantage

Rather than panic, India should (and is) using this as an opportunity to reduce dependency on any one nation. Here’s how:

- Diversification of Export Markets: Reduces risk and gives India stronger bargaining power.

- Strengthening Local Demand: India’s large middle class and digital economy offer a powerful domestic cushion.

- Boosting Self-Reliance: Policies like Make in India, PLI schemes, and Startup India further reduce vulnerability to external shocks.

By depending less on any single country, especially a volatile partner, India gains more control over its economic destiny.

🔁 The Boomerang Effect on the U.S.

If the U.S. imposes heavy tariffs on Indian goods:

- Prices will rise for American consumers, especially for drugs, jewelry, and IT services.

- Inflation could increase as alternate sources are costlier or less reliable.

- Supply chains will be disrupted, especially in high-value niches like software support, back-office operations, and pharma.

In essence, the tariff may hurt India somewhat—but it could hurt the U.S. economy more subtly and longer-term.

🛡️ Conclusion: India’s Economic Backbone Is Strong

The RBI Governor’s remarks are not just defensive; they are data-driven validations of India’s rise. In times of global uncertainty and political posturing, India’s stable, non-political economic institutions like the RBI provide the assurance investors, businesses, and citizens need.

Rather than focusing on rhetoric, India must continue its focus on self-reliance, diversified trade, and economic reform. The world’s fifth-largest economy isn’t “dead”—it’s only getting stronger.

Featured products

-

Apple iPhone 17 (256GB Storage, Black)

-

HP 15 AMD Ryzen 3 7320U Laptop – Affordable Performance with Style

-

HP 15 Laptop – 13th Gen Intel Core i3 (12GB RAM, 512GB SSD)

Original price was: ₹52,721.00.₹33,990.00Current price is: ₹33,990.00. -

Lenovo SmartChoice Chromebook (82UY0014HA) – Compact & Affordable Everyday Laptop

-

Little Monk Buddha Statue Set

Original price was: ₹1,299.00.₹134.00Current price is: ₹134.00. -

MS Office Online Course: Basic to Advance Level

Original price was: ₹2,999.00.₹2,499.00Current price is: ₹2,499.00. -

Noise Buds VS102

Original price was: ₹2,999.00.₹799.00Current price is: ₹799.00. -

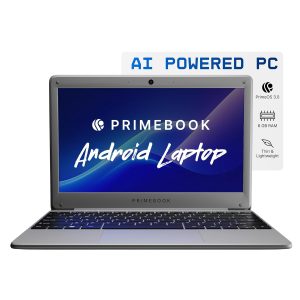

Primebook 2 Neo 2025 – The Next-Gen Budget Laptop for Students & Professionals

-

Shilajit Energy Sips – Natural Energy Boost