Your cart is currently empty!

Recording VAT Entries in Tally.ERP 9 with Detailed Steps and Examples

VAT entry in Tally.ERP 9 is essential for businesses to accurately record Value Added Tax transactions. Below, I will guide you through the process step-by-step, including examples and explanations:

Step 1: Create VAT Ledgers

- Access Ledger Creation: Open Tally.ERP 9 and navigate to Gateway of Tally > Accounts Info > Ledgers > Create.

- Create VAT Ledger: Create a ledger named ‘VAT Input’ and ‘VAT Output’ under the group ‘Duties & Taxes’.

Step 2: Enable VAT in Tally

- Activate VAT: Go to Gateway of Tally > F11: Features > F3: Statutory & Taxation.

- Enable VAT: Set ‘Enable Value Added Tax (VAT)’ to ‘Yes’.

Step 3: Make Sales Entry with VAT

- Create Sales Voucher: Go to Gateway of Tally > Accounting Vouchers > F8: Sales.

- Enter Sales Details: Fill in the necessary details like the party’s name, invoice number, date, and sales amount (e.g., Rs. 10,000).

- Select VAT Ledger: In the Accounting Voucher screen, under Particulars, select the sales ledger and enter the sales amount.

- Specify VAT Rate: In the Tax Analysis screen, select the VAT ledger and enter the applicable VAT rate (e.g., 12.5%).

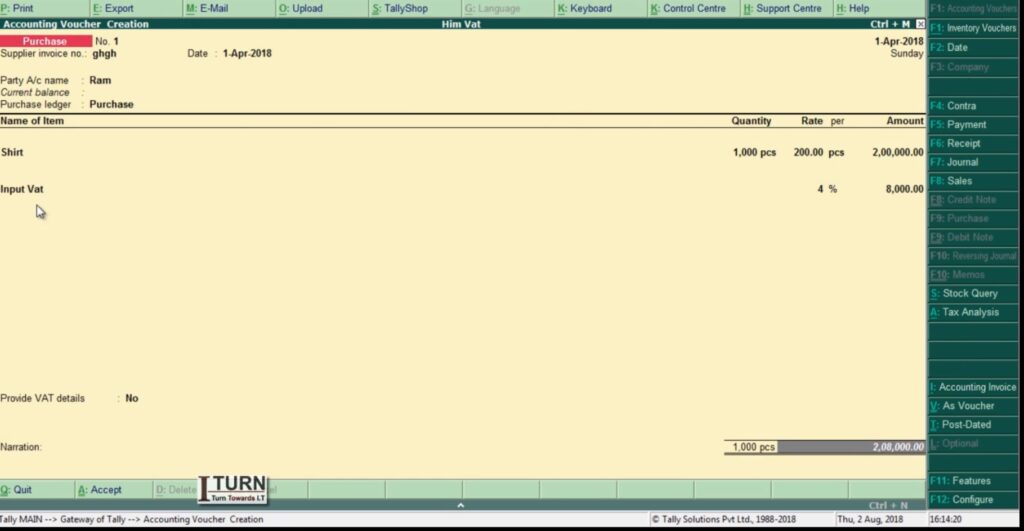

Step 4: Record Purchase Entry with VAT

- Create Purchase Voucher: Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

- Enter Purchase Details: Fill in the necessary details like the supplier’s name, invoice number, date, and purchase amount (e.g., Rs. 8,000).

- Select VAT Ledger: In the Accounting Voucher screen, under Particulars, select the purchase ledger and enter the purchase amount.

- Specify VAT Rate: In the Tax Analysis screen, select the VAT ledger and enter the applicable VAT rate (e.g., 12.5%).

Step 5: View VAT Reports

- Access VAT Reports: Go to Gateway of Tally > Display > Statutory Reports > VAT.

- Generate VAT Computation: Select the period for which you want to view the VAT computation.

- Review VAT Details: You can view details like total sales, total purchases, input VAT, output VAT, and VAT payable.

Example:

Let’s consider a scenario:

- Sales amount: Rs. 50,000

- Purchase amount: Rs. 30,000

- VAT rate: 12.5%

Sales Entry:

- Create a sales voucher.

- Enter the sales details: Party name, invoice number, date, and sales amount (Rs. 50,000).

- Select the sales ledger and enter the sales amount.

- Specify the VAT rate as 12.5%.

Purchase Entry:

- Create a purchase voucher.

- Enter the purchase details: Supplier’s name, invoice number, date, and purchase amount (Rs. 30,000).

- Select the purchase ledger and enter the purchase amount.

- Specify the VAT rate as 12.5%.

Summary:

- Enable VAT in Tally.

- Create VAT ledgers for input and output.

- Record sales and purchase transactions separately.

- Specify the VAT rate for each transaction.

- Review VAT reports to ensure accurate computation.

By following these steps and example, you can effectively manage VAT entries in Tally.ERP 9 for your business transactions.

Leave a Reply