Your cart is currently empty!

Applying VAT on Fixed Assets in Tally.ERP 9 – Step-by-Step Tutorial with Examples

In Tally.ERP 9, applying VAT (Value Added Tax) on fixed assets involves a few steps. Here’s a comprehensive guide on how to apply VAT on fixed assets in Tally.ERP 9:

Step 1: Creating Fixed Assets Ledger:

- Go to Gateway of Tally > Accounts Info > Ledger > Create.

- Create a ledger named “Fixed Assets” under the group “Fixed Assets”.

Step 2: Enabling VAT in Tally.ERP 9:

- Go to Gateway of Tally > F11: Features > F3: Statutory & Taxation.

- Enable VAT by selecting “Yes” in the option “Enable Value Added Tax (VAT)?”

Step 3: Creating VAT Ledger:

- Go to Gateway of Tally > Accounts Info > Ledger > Create.

- Create a ledger named “VAT @ X%” (replace X with your applicable VAT rate) under the group “Duties & Taxes”.

Step 4: Recording Purchase of Fixed Asset with VAT:

- Go to Gateway of Tally > Accounting Vouchers > F9: Purchase.

- Enter the date of purchase, supplier invoice number, and other details.

- Debit the “Fixed Assets” ledger with the total amount (excluding VAT).

- Debit the “VAT @ X%” ledger with the VAT amount.

- Credit the supplier’s ledger with the total amount (including VAT).

Step 5: Calculating Input VAT Credit:

- Go to Gateway of Tally > Display > Statutory Reports > VAT > VAT Computation.

- Check the Input VAT credit available against the VAT ledger.

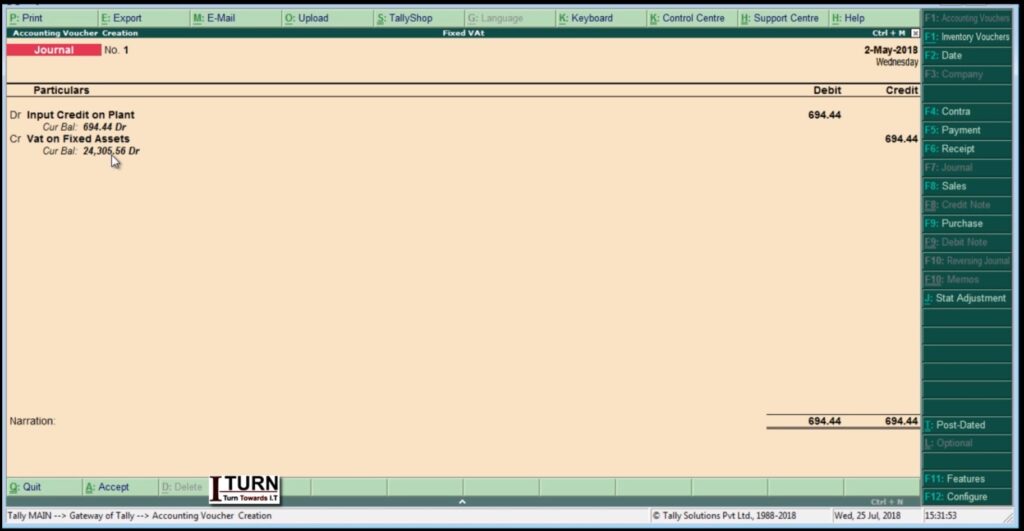

Step 6: Adjusting Input VAT Credit:

- Go to Gateway of Tally > Accounting Vouchers > F7: Journal.

- Debit the Input VAT ledger and credit the VAT Payable ledger to adjust the input VAT credit against the VAT liability.

Step 7: Calculating Depreciation:

- Go to Gateway of Tally > Accounts Info > Ledger > Create.

- Create a ledger named “Depreciation” under the group “Indirect Expenses”.

- Record depreciation entries as per the applicable rates and methods.

Step 8: Recording Sale of Fixed Asset:

- Go to Gateway of Tally > Accounting Vouchers > F8: Sales.

- Enter the date of sale, buyer details, and other necessary information.

- Debit the buyer’s ledger with the sales amount (excluding VAT).

- Credit the “Fixed Assets” ledger with the original purchase cost.

- Credit the “VAT @ X%” ledger with the VAT amount charged on the sale.

Step 9: Paying VAT Liability:

- Go to Gateway of Tally > Display > Statutory Reports > VAT > VAT Challan Reconciliation.

- Check the VAT payable amount.

- Go to Gateway of Tally > Accounting Vouchers > F5: Payment.

- Debit the VAT Payable ledger and credit the bank ledger for paying the VAT liability.

Step 10: Updating VAT Returns:

- Go to Gateway of Tally > Display > Statutory Reports > VAT > VAT Returns.

- Generate VAT returns and file them as per legal requirements.

Throughout these steps, ensure compliance with VAT regulations and consult with a tax advisor if needed.

Leave a Reply